IORR, IOER, and FFR

IORR, IOER, and the FFR

This article seeks to explain how interest rates are set by the Fed. The subject is meant to sound complicated but it is not once one understands that the Fed is trying to keep interest rates low to inflate the stock, housing, and bond bubbles.

In the current fractional reserve banking system, most banks only need to keep about 10% of the money deposited in their bank for safekeeping.[1]

Banks can legally commit fraud because they are required to only hold a fraction (10%) of the money people deposit and can lend out the rest.[2] If they hold less than 10%, they are supposed to get an overnight loan from another bank with excess reserves, the interest on which is called the Federal Funds Rate (FFR).

The FFR is set by the Federal Open Market Committee (FOMC) of the Federal Reserve. It determines all other interest rates.

Per the Saint Louis Federal Reserve’s Federal Reserve Economic Data (FRED) website,[3]

“The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. When a depository institution has surplus balances in its reserve account, it lends to other banks in need of larger balances. In simpler terms, a bank with excess cash, which is often referred to as liquidity, will lend to another bank that needs to quickly raise liquidity. (1) The rate that the borrowing institution pays to the lending institution is determined between the two banks; the weighted average rate for all of these types of negotiations is called the effective federal funds rate.(2) The effective federal funds rate is essentially determined by the market but is influenced by the Federal Reserve through open market operations to reach the federal funds rate target.(2)

The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. As previously stated, this rate influences the effective federal funds rate through open market operations or by buying and selling of government bonds (government debt).(2) More specifically, the Federal Reserve decreases liquidity by selling government bonds, thereby raising the federal funds rate because banks have less liquidity to trade with other banks. Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for trade. Whether the Federal Reserve wants to buy or sell bonds depends on the state of the economy. If the FOMC believes the economy is growing too fast and inflation pressures are inconsistent with the dual mandate of the Federal Reserve, the Committee may set a higher federal funds rate target to temper economic activity. In the opposing scenario, the FOMC may set a lower federal funds rate target to spur greater economic activity.”

The Fed pays interest called the Interest on Required Reserves (IORR) for the 10% required to be held in reserve.

If the banks are holding more than 10% of their required reserves, the Fed will pay Interest On Excess Reserve (IOER) if it is deposited at the Fed.

The IORR and IOER were only recently created because of the Great Recession in 2008, which started in Dec 2007. Per the Federal Reserve’s Board of Governors’ website,[4]

“The Financial Services Regulatory Relief Act of 2006 authorized the Federal Reserve Banks to pay interest on balances held by or on behalf of depository institutions at Reserve Banks, subject to regulations of the Board of Governors, effective October 1, 2011. The effective date of this authority was advanced to October 1, 2008, by the Emergency Economic Stabilization Act of 2008.”

The way that the Fed keeps interest rates low is by buying government bonds from banks, which allows the government to issue more debt to to banks at a lower interest rates than would be the case if the Fed did not print any money.

There is a fear that as the Fed prints money (inflation) to buy US government bonds from the banks, the banks will have too much money to lend to the market instead of earning interest on the FFR, resulting in price inflation.

The IORR and the IOER are used to so that banks can have a base level of interest to earn by simply keeping their money stored at the Fed instead of lending it out on the market. Again, per the Federal Reserve’s Board of Governors’ website,[5]

“According to the Policy Normalization Principles and Plans adopted by the Federal Open Market Committee (FOMC), during monetary policy normalization, the Federal Reserve intends to move the federal funds rate into the target range set by the FOMC primarily by adjusting the IOER rate.”

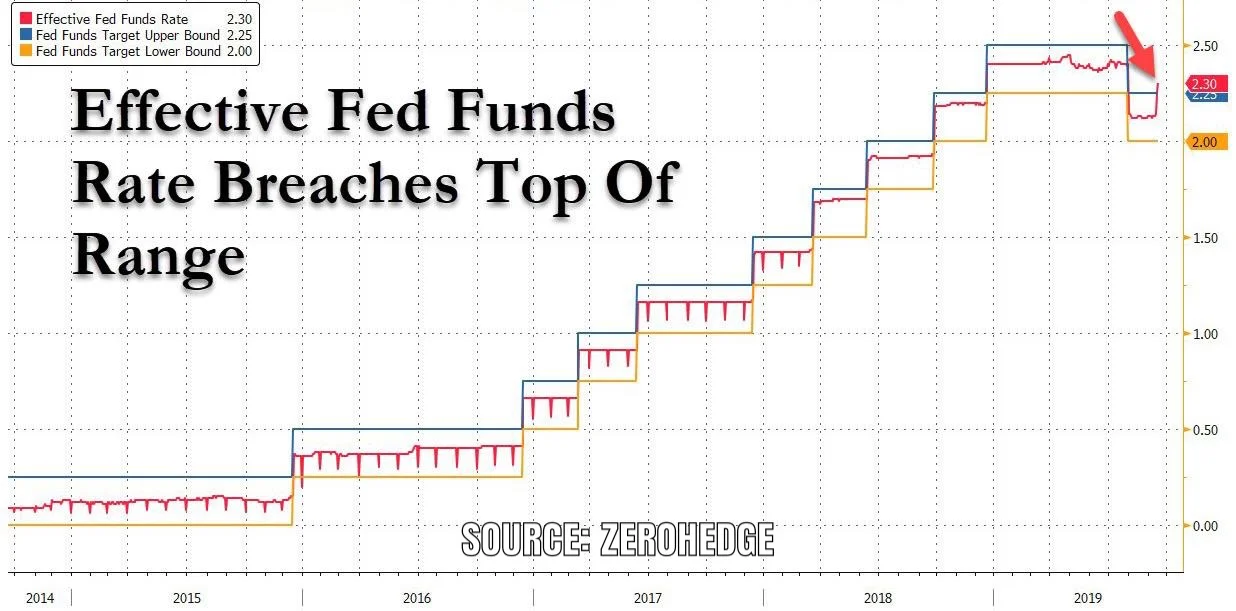

However, the opposite can happen. On September 18th, the Effective Federal Funds Rate, the actual interest rate at which banks lend money to each other overnight, increased higher than the FFR for the first time ever.[6] That means that the Federal Reserve is losing control of interest rates.

Therefore, the Fed will most likely buy more government bonds from banks in an attempt to lower the Effective Federal Funds Rate. This will keep the US government solvent for a little longer, but it will destroy the value of the dollar as it is printed into oblivion.

Or the Fed could raise interest rates by selling government bonds, tanking stocks, housing, and bonds in the process.

Rates could rise higher still even if the Fed lowers interest rates because the Effective Federal Funds Rate could continue to increase higher than the targeted Federal Funds Rate as the Fed loses control of interest rates regardless of their interest rate decision on October 30th.

Therefore, lowering interest rates will eventually be ineffective as investors prefer higher interest rates to reflect the declining value of the dollar.

Watch out for the FOMC’s decision on Oct 30.[7]

Editor’s Note (June 24, 2021): As of March 26, 2020, reserve requirements were reduced to 0% so that the IORR is no longer relevant. All reserve are excess by definition, making the IOER completely replace the IORR.[8]

Editor’s Note (December 13, 2021): As of July 29, 2021, the IORR and IOER were replaced by the Interest On Reserve Balances. The banks get paid to not lend out the money that they aren’t supposed to lend.[9]

[1] https://www.investopedia.com/terms/f/fractionalreservebanking.asp “Banks with less than $16.3 million in assets are not required to hold reserves. Banks with assets of less than $124.2 million but more than $16.3 million have a 3% reserve requirement, and those banks with more than $124.2 million in assets have a 10% reserve requirement.”

[2] Deposits are different from loans made to a bank. When one deposits money in a bank, it is meant to be stored to be withdrawn on demand. Typically the depositor pays a free. This is different from loaning money to a bank for the purpose of the bank making a loan so both parties can earn interest.

[3] https://fred.stlouisfed.org/series/fedfunds

[4]https://www.federalreserve.gov/monetarypolicy/reqresbalances.htm

[5] https://www.federalreserve.gov/monetarypolicy/reqresbalances.htm

[6] https://www.zerohedge.com/markets/fed-funds-prints-230-breaching-target-range-libor-replacement-soars-remarkable-525

[7] https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

[8]https://www.hamiltonmobley.com/blog/upcv79f4gia7ye8rbkz1pf2hs6iq2f

[9]https://fred.stlouisfed.org/series/IOER

“Starting July 29, 2021, the interest rate on excess reserves (IOER) and the interest rate on required reserves (IORR) were replaced with a single rate, the interest rate on reserve balances (IORB). See the source's announcement for more details.”