Fractional Reserve Banking

Fractional Reserve Banking

A bank is a place where people with vaults are paid to store money (deposits) or create a contract to loan out other peoples’ money, earning interest and generating a profit.

Fractional Reserve Banking, also known as fraud, is where a bank only keeps 10%[1] of the cash that it claims is deposited and lends out the rest. The newly created money gets deposited in a second bank. The second bank only keep 10% in case people want to use cash and repeats the process.

The Federal Reserve (Fed) was created in 1913 by an illegal act of the US’ Congress and prints money (a bank note). They are a Federation of banks but keep their member banks secret (JP Morgan is probably a member). Their Federal Reserve Notes (cash) were originally backed by gold held at the Treasury or Federal Reserve Bank. The Fed printed more cash than they had gold.* The newly printed cash was lent out to banks who only kept 10% on deposit, furthering inflating the money supply.

In 1929, markets were priced off of the gold and paper fractional reserve money supply. When people began demanding their deposits and selling their stocks to pay off loans and bad investments, market prices crashed towards the gold and silver money supply.[2] People ran to the banks to get their money out. Since, at most, only 10% was actually physical cash or gold, bank runs turned into banks collapses.[3] The people with cash could not even get their gold.

It is gotten worse since 2008. Now there is absolutely no gold or silver backing the cash and most people do not even have cash. The Fed does not any longer print most of the money created. People use credit/debit cards. Their wealth only exists on a computer screen.

The threat of fractional reserve banking is that the inflated money supply can quickly disappear as magically as it was created if enough people want cash.

The Federal Deposit Insurance Corporation (FDIC) was created in 1933[4] to prevent bank runs because of fractional reserve banking. The FDIC is backed by the US taxpayer and Federal Reserve. In 2009 the FDIC ran out of money.[5]

Today, the only thing that the Fed can do to delay a collapse is to print money to bail out banks who have more debt than money.[6] That is good for gold prices.

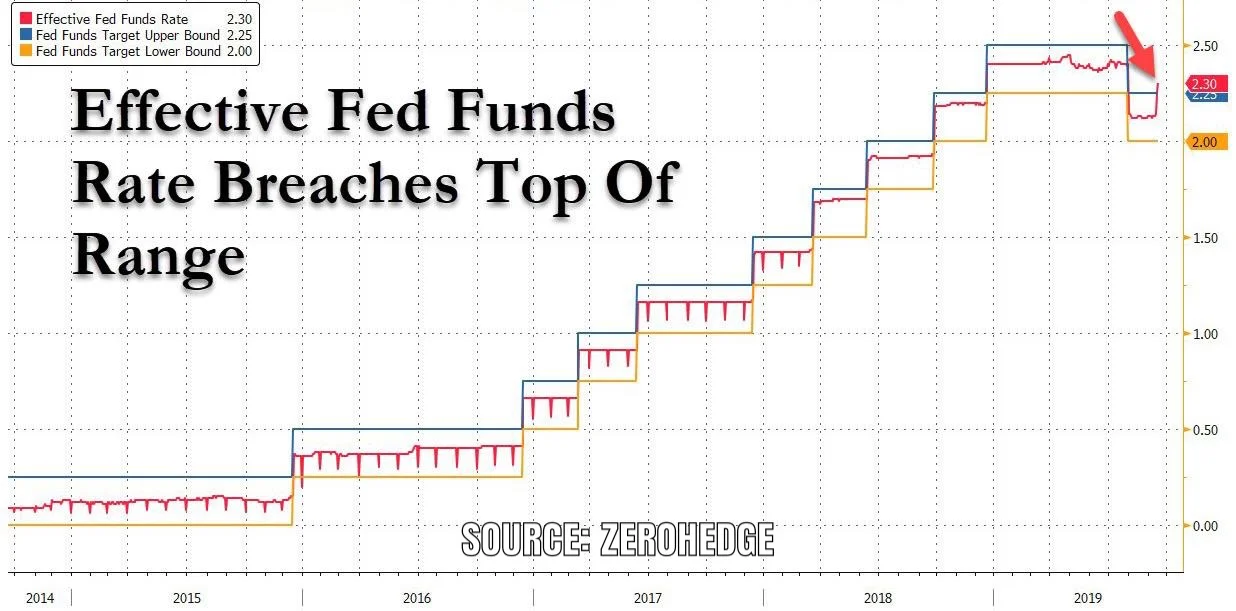

Or the Fed can let interest rates rise by not printing money and not increasing loans, pop bubbles, decrease the fractional reserve money supply, and result in prices returning to a base level of money: gold and silver.

Much of the computer wealth will vanish. Cash will be valuable money. Gold and silver even more so.

How much of your wealth exists in a computer game?

*Technically the United States Bureau of Engraving and Printing in the Treasury Department prints physical Federal Reserve notes. They used to also print US Treasury notes backed by gold in the Treasury. The Fed just credits accounts with digital dollars.

[Update March 11, 2022: Reserve Requirements were reduced to 0% on March 26, 2020]

https://www.hamiltonmobley.com/blog/upcv79f4gia7ye8rbkz1pf2hs6iq2f

[1] https://www.investopedia.com/terms/f/fractionalreservebanking.asp “Banks with less than $16.3 million in assets are not required to hold reserves. Banks with assets of less than $124.2 million but more than $16.3 million have a 3% reserve requirement, and those banks with more than $124.2 million in assets have a 10% reserve requirement.”

[2] https://mises-media.s3.amazonaws.com/History%20of%20Money%20and%20Banking%20in%20the%20United%20States%20The%20Colonial%20Era%20to%20World%20War%20II_2.pdf Page 103, “Whereas in 1929- 1933, real gross investment fell catastrophically by 91 percent, real consumption by 19 percent, and real GNP by 30 percent…”

[3] https://mises.org/library/anatomy-bank-run

[4] https://www.fdic.gov/about/history/

[5] https://www.npr.org/sections/money/2009/11/fdic_in_the_red.html

[6] https://www.zerohedge.com/markets/fed-begins-repo-operation-funding-rates-ease