Wildcat Banking

In the early American Republic, banks would be charted in states and issue paper money backed by real money, which was gold and silver per Article I, Section 10, Clause 1 of the US Constitution.

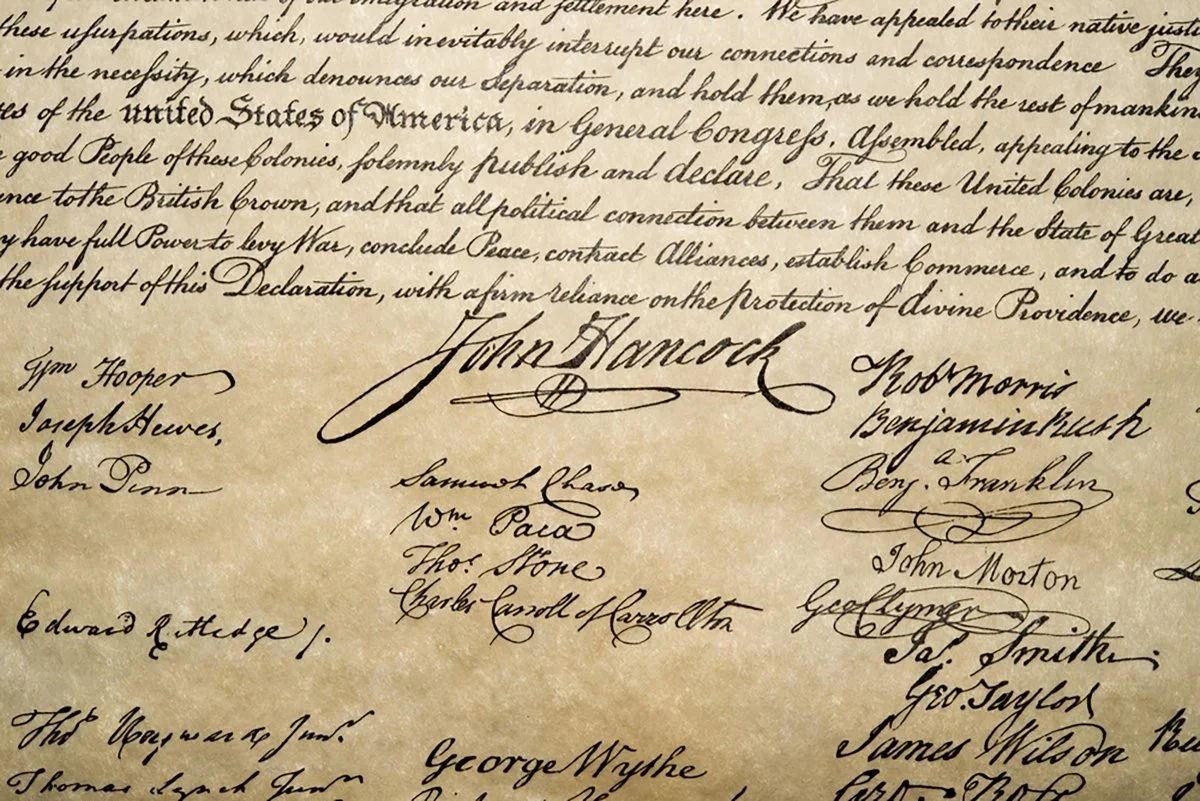

“No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility.”

While it was illegal for states to emit bills of credit (bank notes/ paper money), private banks could.

Wildcat Banking is a term to describe the practice by banks of lending out more money than they had- often by being located in remote areas being settled out West. The banks would value mortgages and bonds that they had to be as good as gold, create paper money, and when people came to exchange their paper money for gold, the banks would then go bankrupt. The banks would go out of business when people decided that they wanted the gold more than the paper money.

Per Britannia,[1]

“wildcat bank, unsound bank chartered under state law during the period of uncontrolled state banking (1816–63) in the United States. Such banks distributed nearly worthless currency backed by questionable security (e.g., mortgages, bonds) and were located in inaccessible areas to discourage note redemption. Note circulation by state banks ended after the passage of the National Bank Act of 1863, which provided for the incorporation of national banks under federal law and the issue of bank notes on the security of government bonds. The term wildcat bank was subsequently applied to any unstable bank.”

Per Rothbard,[2]

“‘Wildcat’ banks were so named because in that age of poor transportation, banks hoping to inflate and not worry about redemption attempted to locate in ‘wildcat’ country where money brokers would find it difficult to travel. It should be noted that if it were not for periodic suspension, there would have been no room for wildcat banks or for varying degrees of lack of confidence in the genuineness of specie redemption at any given time.”

-Murray N. Rothbard, A History of Money and Banking in the United States: The Colonial Era to WWII, page 78.

In modern times, crypto currencies are like Wildcat banknotes (paper money). However, they don’t back their digital-paper money with gold and silver. People think crypto is valuable because they think that they can sell them for more dollars than they bought them.

There is one notable exception: Tether.

Recently, Tether has acquired a tonne of gold. 116 metric tons, to be exact (1000 kilograms per ton). The CEO, Paolo Ardoino, called gold “natural bitcoin,” per the Financial Times. He is backing Tether with real money.[3][4]

These gold purchases have led some people to speculate that Tether might be the USA secretly buying gold.

Tether may survive as gold backed money, but cryptos are fundamentally digital-paper money for Wildcat banks.

So, while crypto may be worthless in the end, at least the computers and the gold in the computers that “mine” cryptos are valuable. Indeed, Eric Trump recently promoted his bitcoin mining facility, saying that he had 35,000 servers. Assuming that each server has .3 grams of gold electronics, that makes at least 337 ounces of gold hardware. The servers in that facility can be recycled for their gold content when gold is worth more than the bitcoin they mine.

Junkyards will be goldmines.

[1]https://www.britannica.com/money/wildcat-bank

[3]https://www.ft.com/content/37f80249-2ca0-4369-9898-bde2689d443a