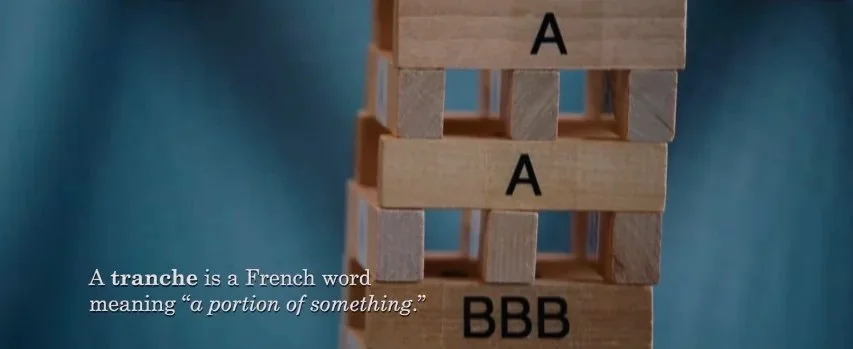

Tranche II

According to Russia Direct, Putin’s advisor Anton Kobyakov said that crypto and gold were alternatives to the dollar, and that the price of cryptos would be inflated and then sold to pay off the debt, or to be used in lieu of dollars to pay off the debt. Essentially, it is the argument that Scott Bessent made on August 18, 2025 as published by the author in Tranche.[1]

Dr. Kobyakov made these comments while speaking in Russian on September 6th at the Eastern Economic Forum in Vladivostok, Russia.[2]

Per the translation from Russia Direct, Dr. Kobyakov said,

“The U.S. is now trying to rewrite the rules of the gold and cryptocurrency markets. Remember the size of their debt—35 trillion dollars. These two sectors (crypto and gold) are essentially alternatives to the traditional global currency system. Washington’s actions in this area clearly highlight one of its main goals: to urgently address the declining trust in the dollar. As in the 1930s and the 1970s, the U.S. plans to solve its financial problems at the world’s expense—this time by pushing everyone into the ‘crypto cloud.’ Over time, once part of the U.S. national debt is placed into stablecoins, Washington will devalue that debt. Put simply: they have a $35 trillion currency debt, they’ll move it into the crypto cloud, devalue it—and start from scratch. That’s the reality for those who are so enthusiastic about crypto.”

Dr. Kobyakov’s biography can be found at this link. He holds a doctorate in economics: http://www.en.kremlin.ru/catalog/persons/373/biography

Gold can fulfill the same function, as gold and silver did in the Funding Act of 1790. E.g. If an ounce of gold costs $1 trillion, then only 37 ounces of gold are required to pay off the Federal debt (it is $37 trillion not $35 trillion). The USA can’t print money forever.[4]