The New Denarius

Following the Crisis of the 3rd Century AD that split the Roman Empire between East and West, largely caused by the debasement of the silver denarius, the gold solidus became the basis of trade. The silver coins would be debased at different times over the following centuries, and 300 years after the Western Roman Empire turned into the Western Roman Federation (feudalism) in 476, Pepin the Short, the father of Western Roman Emperor Charlamagne, created the novus denarius, the new denarius.

The gold solidus was created in 312 by the Roman Emperor Constantine. The solidus weighed 4.5 grams with a purity of .958, making its gold weight 4.311 grams. From 312 until the Eastern Romans lost the Battle of Manzikert and most of their remaining heartland in Asia Minor to the Turks in 1071, the solidus was the standard for trade in the lands formerly ruled by Rome.[1][2]

Roman cultural dominance was displayed in the Muslim caliphate. As Muslims conquered the Iranian Sassanid and most of the Eastern Roman Empire in the 7th and 8th centuries- including Syria, Egypt, North Africa, and Spain- they copied those empire’s monies. They used the Iranian dirham (from the Greek silver drachma) and the gold dinar, named after the Roman silver denarius. It was a copy of the solidus.

According to the Islamic Monetary Council based out of London,[3]

“Historically, the 1 dinar coin has been equivalent to 4.25g of gold. However, dinar coins have had varying weights in the past and were not always 4.25g.”

After the end of the Western Roman Empire in 476, Roman cultural dominance was also displayed in the Western Roman federation of Germanic tribes, loosely organized around the Roman Catholic Church in Rome and the Roman Emperor in Constantinople. The Eastern Romans conquered Rome from the feudal lords in the 6th century, and Rome would remain in the empire until 756. Feudalism and federalism are both rooted in the term Foederati, who were German tribes in a federation with Rome. The federal soldiers were called soldiers because they were paid for their military service with the gold solidus.[4][5][6]

The Franks were former federal soldiers who dominated the West. In 755, the Frankish King Pepin the Short started minting “new Denarii,” commonly called deniers to standardize the coinage in the Frankish kingdom.

Pepin’s son, Charlemagne, conquered and ruled most of what remained of Roman Catholic Europe. He was crowned Emperor of the (Western) Romans by the Pope in Rome in the year 800. He standardized the weight of the new denarius at 1.7 grams of silver. 12 deniers were worth one solidus, which is an exchange rate of 4.5 grams of silver for 1 gram of gold!

Per APMEX,[7]

“Charlemagne built upon Pepin’s reforms during his rule, implementing significant changes around 793/794. Whereas Pepin the Short standardized denominations, Charlemagne standardized weights, introducing a uniform pound of silver (approximately 408 grams). This ensured that 240 silver deniers could be struck from a single pound. This reform was designed to leverage Europe’s abundant silver deposits, minimize reliance on scarce gold, and provide a framework that facilitated trade.”

Continuing, APMEX notes,

“The Carolingian system was a structure characterized by its reliance on three denominations: the libra (pound), the solidus (shilling), and the denarius (denier). Its 1:20:240 ratio ensured consistent relationships between these units, with only the denier minted as a physical coin. The consistent valuation and weight of the denier fostered confidence in trade, encouraging merchants to engage in transactions. Additionally, the denier’s prominence influenced later European coins, including the English sterling system and the German pfennig.”

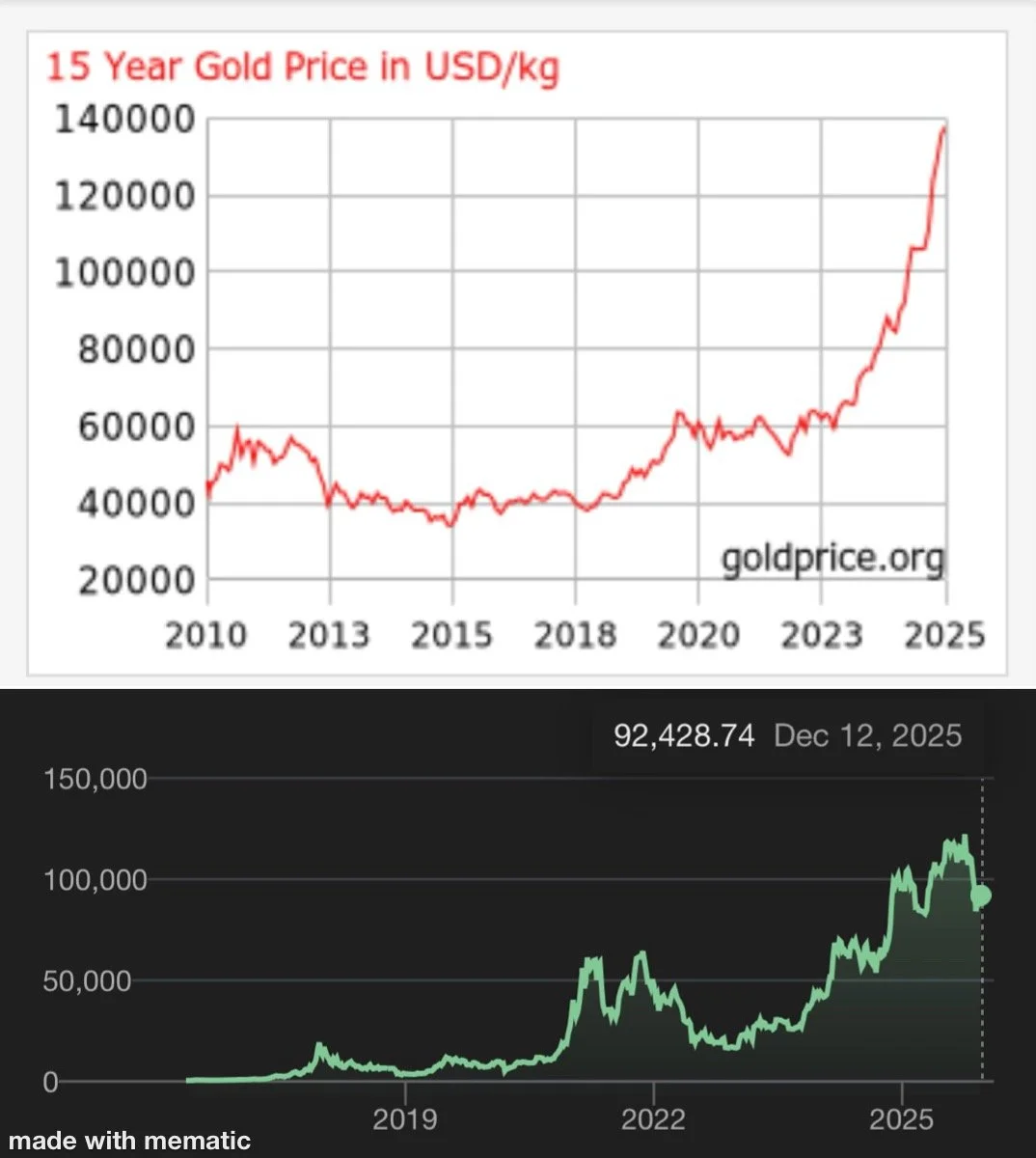

Something similar is happening in the USA. Since the 1980’s, the USA have been minting their own new dollars.

The dollar used to be a silver dollar of 24.05 grams of silver, with 20 dollars equaling a Troy ounce of gold (31.1 grams). That is a 15 to 1 exchange rate. Today, a silver dollar is 31.1 grams of silver. It has no official exchange rate with gold, but at a paper dollar price of $67 for an ounce of silver and $4,300 for an ounce of gold, that makes a 64 to 1 exchange rate.

Many people are buying silver in the hopes that it might go back to a 15 to 1 exchange rate, meaning that for the same amount of paper dollars, one could buy 1 ounce of gold or 64 ounces of silver. If the exchange rate goes back to 15 to 1, then those 64 silver ounces could be exchanged for 4.2 ounces of gold.

Why buy 1 ounce of gold when you can buy 4.2 ounces of gold for the same amount of paper dollars? Imagine if it goes back to the exchange rate of Emperor Charlemagne. The new dollar is silver.

[1]https://www.youtube.com/watch?v=1Kk3-l-QIEc&t=618s

[2]https://learn.apmex.com/answers/what-is-a-gold-solidus/

[3]https://islamicmonetarycouncil.org/muslim-assayers-council/islamic-monetary-sizes.html

[4]https://www.hamiltonmobley.com/blog/dei-divide-et-impera

[5]https://www.britannica.com/place/Papal-States