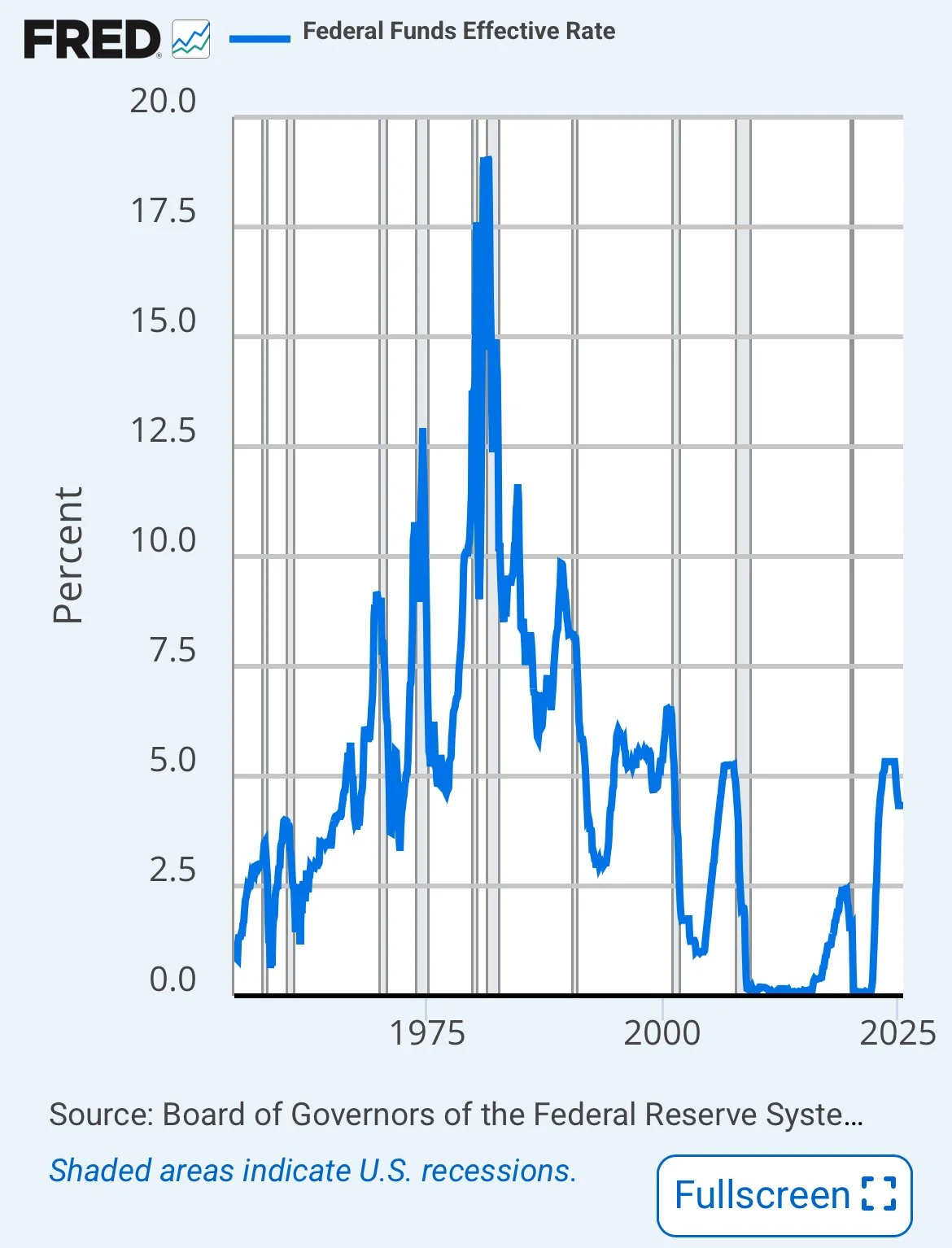

Printing Money Lowers Interest Rates, Until It Does Not.

Michael Plante, Alexander W. Richter, and Sarah Zubairy of the Dallas Federal Reserve Bank published an article entitled, How sensitive are interest rates to higher federal debt? They explain how more debt will raise interest rates. The Federal Reserve lowers interest rates by buying US debt. This is the end game.

The 3 authors argue that more debt will raise interest rates. In their article, they conclude,[1]

“Rising debt levels are likely to push up interest rates on U.S. government debt. We find that each percentage point increase in the debt-GDP ratio increases long-term interest rates by about 3 basis points. Our estimate is substantially larger than the 0.7 basis point effect estimated using the traditional approach—which we argue is affected by statistical issues—and also larger than the 2-basis-point effect the CBO uses for its analysis and projections.”

That a Federal Reserve Bank would let economists publish an article saying that rising debt levels are likely to raise interest rates is important because the Federal Reserve lowers interest rates by buying US government debt from big banks with the money that they print. They do this by lowering the federal funds rate, which influences all interest rates, particularly loans to the US Treasury.[2]

The Federal Reserve Economic Department (FRED) have changed the description on their website sometime in the last month or so, but their description of the federal funds rate is,

“The federal funds rate is the central interest rate in the U.S. financial market. It influences other interest rates such as the prime rate, which is the rate banks charge their customers with higher credit ratings. Additionally, the federal funds rate indirectly influences longer- term interest rates such as mortgages, loans, and savings, all of which are very important to consumer wealth and confidence.”

FRED’s description of the federal funds rate used to include, as quoted from, IORR, IOER, and FFR- an article I wrote on my blog about the federal funds rate (FFR) in 2019,[3]

“The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. As previously stated, this rate influences the effective federal funds rate through open market operations or by buying and selling of government bonds (government debt).(2) More specifically, the Federal Reserve decreases liquidity by selling government bonds, thereby raising the federal funds rate because banks have less liquidity to trade with other banks. Similarly, the Federal Reserve can increase liquidity by buying government bonds, decreasing the federal funds rate because banks have excess liquidity for trade. Whether the Federal Reserve wants to buy or sell bonds depends on the state of the economy. If the FOMC believes the economy is growing too fast and inflation pressures are inconsistent with the dual mandate of the Federal Reserve, the Committee may set a higher federal funds rate target to temper economic activity. In the opposing scenario, the FOMC may set a lower federal funds rate target to spur greater economic activity.”

If printing dollars (increasing liquidity) to buy US debt doesn’t lower interest rates for US debt anymore, then either the dollar becomes worth less and less until it is worthless or interest rates skyrocket. It could be both. For a deep dive, read the 4th source below.[4]

Printing money lowers interest rates until it doesn’t, and physical bitcoin is money when the paper dollar isn’t worth a continental.[5]

Powell knows how it ends.

“I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so. Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.” -Jerome Powell, Chairman of the Federal Reserve, then member of the Board of Governors, Oct 2012 Federal Open Market Committee Meeting.

[1]https://www.dallasfed.org/research/economics/2025/0812

[2]https://fred.stlouisfed.org/series/fedfund

[3]https://www.hamiltonmobley.com/blog/iorr-ioer-and-ffr

[4]https://www.hamiltonmobley.com/blog/printing-money-lowers-interest-rates